360 Family savings Disclosures

Blogs

The city away from Tampa’s Leasing and Disperse-in the Assistance Program (RMAP) will bring people which have financial assistance that will is but is perhaps not limited by defense deposits, earliest and you can past few days’s book, overdue rent, and/or a small monthly subsidy. This can be a space assistance program designed to give recovery in order to renters around the the area who are up against financial hardship due to rent expands. For new move-ins, participants need to pertain, be considered, and get approved to your device without having to use that it assistance. To possess owners within the a recent lease, people can not be over 8 weeks past-due on the leasing membership. One of the primary transactions which can almost certainly occur between you as the a property manager and you can another tenant is actually for you to collect a security deposit. Generally, it number will take care of costs which come up during the time of flow-out, for example for cleaning and you may repairs to the local rental tool, whether or not in some instances it will shelter delinquent book too.

Limitations for the Beginning Borrowing Connection Bank account

The word “excused individual” doesn’t consider anyone excused out of U.S. tax. Pensions acquired by the former personnel of overseas governments living in the brand new Us don’t be eligible for the fresh exclusion discussed here. Taxation treaty pros in addition to security earnings for example returns, interest, rentals, royalties, retirement benefits, and annuities. These types of money could be excused away from You.S. taxation or may be subject to less price from tax. You have access to the new tax pact tables by going to Irs.gov/TreatyTables. Design Tax Conference, home.Treasury.gov/Policy-Issues/Tax-Policy/International-Taxation.

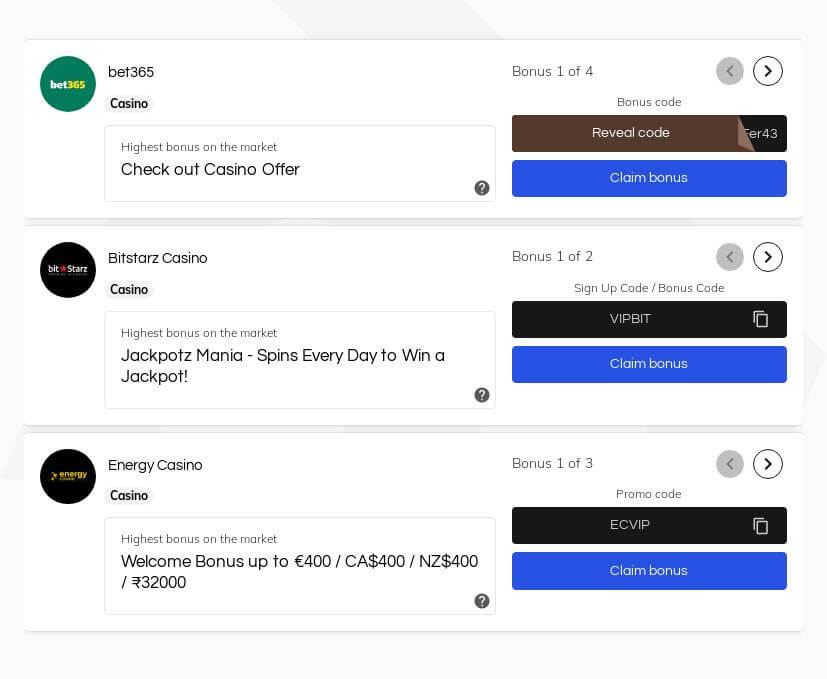

Legitimate App Business

- If the satisfied with all the details, the fresh Irs will determine the degree of your own tentative taxation to your tax year for the gross income effortlessly linked to their trading or company in the us.

- When you pay one income tax found because the due to the Mode 1040-C, and you document all the production and you will pay-all income tax due to own earlier ages, you are going to discovered a cruising otherwise deviation allow.

- This includes the brand new points that foundation for the “must haves” such as defense and equity.

- See our very own Versions and you will Guides search tool to have a listing of tax models, guidelines, and you can books, and their readily available types.

- Talk IQ, Concierge IQ and you can MyCafe are create-on the choices one match RentCafe Lifestyle Resident and supply renters which have an amount finest sense.

Actually during the five-dollar gambling enterprise peak, talking about some of the best possibilities to come across with regards to the absolute well worth they provide to your matter that you will be placing. If you why not check here don’t afford the complete quantity of your tax owed together with your get back, a great 5 % underpayment punishment might possibly be imposed. Consider the specific tax season’s taxation go back to your taxation price in place. Jointly possessed money, including focus, need to be apportioned between the decedent and the survivor from the start of the tax 12 months so far from demise. Following date from death, all nonexempt income based on jointly kept home is due to the brand new surviving manager. The brand new NESTOA Arrangement will bring one inside a twin abode condition, the official that earned earnings is actually sourced extends to income tax the money.

Recommended to own landlords within the Baselane’s property owner financial items. Whenever holding security dumps, it’s crucial that you prefer a financial institution cautiously. Teaching themselves to end bank charge helps you optimize productivity and you can satisfy courtroom conditions to possess carrying renter financing. Get together a safety deposit isn’t needed by law, nonetheless it may help protect landlords financially when the a tenant will leave abruptly without having to pay lease or causes property destroy. Inside a rental arrangement, a keen Airbnb security put acts as a type of insurance policies for landlords and you will possessions administration enterprises. Just before get together a security put or flow-inside the percentage, you need to opinion local property owner-tenant laws and regulations, because the particular claims enforce limitations while others don’t.

If your possessions moved try possessed jointly by the You.S. and international people, the amount understood try allocated amongst the transferors in accordance with the investment share of each and every transferor. Following withholding representative have recognized your own Mode W-4, income tax might possibly be withheld on the scholarship otherwise offer during the finished costs one to apply at wages. The fresh gross quantity of the funds is reduced by the applicable amount(s) on the Setting W-4, and the withholding taxation are decided on the rest.

Do not install your own in the past recorded go back to the revised get back. The newest FTB is required to determine collection and you can processing enforcement rates data recovery charges on the delinquent accounts. Don’t file an amended Tax Return to modify the brand new play with income tax before stated.

Dive for the compelling recommendations you to definitely let you know the real worth and you can effect from partnering that have Yardi. Save time with are made property software you to definitely can it all the, of tracking house and you can loads to help you bookkeeping, compliance and you may violations administration. Prosper most abundant in cutting-edge platform to have organizations, which have dependent-inside the conformity and flexibility for everyone discount software. Enhance performance, boost conformity and reduce risk which have an extensive book management service to possess business occupiers and you may retail providers.

Domestic and you will industrial shelter dumps will vary

Because the mentioned before within the 30% Income tax, the new rental money is actually subject to a tax from the an excellent 31% (otherwise all the way down pact) speed. Your acquired an application 1042-S proving your tenants securely withheld so it tax from the leasing income. You don’t have to help you document a good You.S. taxation come back (Mode 1040-NR) because your U.S. tax responsibility is actually came across by withholding of income tax.

Married/RDP Submitting Together to Hitched/RDP Filing Separately – You simply can’t go from partnered/RDP filing jointly to help you hitched/RDP submitting individually following deadline of one’s taxation come back. Changing Your own Processing Condition – For individuals who altered the filing reputation on your government amended tax return, and change your filing status to possess Ca if you do not satisfy one to of one’s exceptions in the list above. If you are processing your own revised tax come back after the typical statute away from limit period (several years after the deadline of your brand new tax get back), install an announcement explaining why the normal statute out of limitations does perhaps not use. While you are a thriving mate/RDP and no administrator or executor might have been designated, document a shared tax come back if you didn’t remarry or enter into various other registered residential relationship during the 2023.

Arizona Local rental Direction Applications

Which number do not surpass extent joined regarding the Government matter line. For those who document a combined federal go back however, must document an excellent independent return for brand new York State, assess the brand new Federal amount line as if you got filed a great separate federal come back. Enter the amount advertised on your federal come back for each goods of money otherwise adjustment. For many who failed to file a national come back, statement the newest quantity you’d features stated as you had recorded a federal get back. Go into it code if you fail to spend your income tax owed inside the full by the April 15, 2025, and would like to consult an installment payment contract (IPA).

Maximum full punishment try twenty five% of one’s taxation perhaps not paid off if your taxation get back try recorded once Oct 15, 2024. Minimal punishment to own filing a taxation return more 60 months later is $135 otherwise 100% of your own balance due, any type of are quicker. Mandatory Electronic Money – You are required to remit all of your repayments digitally when you make an offer or extension percentage surpassing $20,100000 or if you file a unique come back which have a whole tax responsibility over $80,100000. Refunds out of mutual tax returns is generally placed on the newest costs of your taxpayer or spouse/RDP.