Thank you for visiting EFTPS porno teens double on the internet

Blogs

Enter the necessary more information for many who looked the package to your range 3 otherwise range 5. If you are looking for zero-rates otherwise lowest-prices health care exposure suggestions, read the “Yes” container to the Setting 540, Front 5. See specific line recommendations to possess Form 540, Medical care Visibility Guidance section. For more information, rating form FTB 3872 and see Roentgen&TC Point 18572. Revealing Requirements – Taxpayers must document setting FTB 4197, Information about Tax Cost Issues, for the income tax go back to report tax cost things as part of your own FTB’s yearly revealing standards lower than R&TC Part 41. To choose for those who have an enthusiastic Roentgen&TC Area 41 reporting requirements, comprehend the Roentgen&TC Point 41 Reporting Criteria area or rating setting FTB 4197.

Realistic cause is thought whenever 90% of one’s tax shown on the go back is actually paid off from the brand new due date of one’s get back. If, once April 15, 2025, you see that your particular estimate of taxation owed is as well reduced, spend the money for additional taxation as soon as possible to prevent otherwise remove after that buildup out of charges and you will attention. The minimum penalty to have processing a tax go back more than sixty days late try $135 or 100% of your own balance due, almost any try shorter. To learn more see parks.california.gov/annualpass/ or email If the hitched/otherwise an enthusiastic RDP and you will filing separate tax returns, you and your partner/RDP need both one another itemize their write-offs (even when the itemized write-offs of 1 partner/RDP is less than the high quality deduction) or both make the basic deduction. Lead Put Reimburse – You might consult a direct put reimburse on your income tax come back if you e-document or document a newsprint taxation go back.

However, might always pay far more tax than if you are using various other filing reputation the place you be considered. And, if you file an alternative return, you can not use the education loan desire deduction or perhaps the degree credit, and only be able to make earned income credit and you will son and you can founded proper care borrowing from the bank within the not a lot of things. You additionally can not take the standard deduction should your mate itemizes write-offs. To own issues when you may want to file independently, come across Joint and some tax liability, earlier.

Porno teens double: Army Servicemembers

Beneficiaries might be named throughout these profile, however, that does not add more the new deposit insurance policies visibility. Fool around with our very own automatic mobile phone solution discover filed ways to of a lot of one’s questions about Ca fees and purchase most recent year personal taxation forms and you can books. Look at the Social Shelter Count (or ITIN) – Find out if you may have authored the personal defense matter (otherwise ITIN) in the areas provided towards the top of Mode 540NR.

Exactly what you need to know one which just complete Form 540 2EZ

Utilize this Ip PIN on your own 2024 return as well as porno teens double people earlier-season production your document in the 2025. You can’t make use of the Thinking-Discover PIN means while you are a first-go out filer less than years 16 at the end of 2024. You should handwrite their trademark on your own come back for those who document they on paper. Digital, digital, otherwise composed-font signatures aren’t valid signatures to possess Models 1040 otherwise 1040-SR filed written down.

Licensed Team Earnings Deduction (Section 199A Deduction)

Get into their jury obligation pay for those who offered the fresh spend in order to your boss because your boss paid off your own salary when you served to your jury. Certified degree expenditures generally is university fees, charges, area and you can panel, and you can related expenses such books and you may provides. The expenses have to be to own degree in the a qualification, certification, otherwise equivalent system during the an eligible academic institution. A qualified instructional business includes extremely universities, universities, and you can certain vocational universities. You can get so it deduction as long as all pursuing the implement. For individuals who weren’t protected by a retirement plan but your partner is, you’re experienced protected by a plan if you do not stayed apart from the companion for everyone from 2024.

Credit Chart

The fresh taxation borrowing amount according from a qualified company for a keen applicable strength costs seasons might possibly be computed per appropriate province the spot where the qualified business got group regarding the schedule season the spot where the energy costs 12 months starts. To mitigate against the results of mineral price volatility for the prospective recapture of your taxation borrowing from the bank, Funds in addition to offers to give a secure harbour signal relevant in order to the newest recapture laws. Facts in respect for the design of the fresh safer harbour signal will be provided at a later date.

Taxpayers feel the right to predict appropriate step will be drawn facing group, return preparers, while some just who wrongfully fool around with or disclose taxpayer go back suggestions. Although we cannot function myself every single opinion received, i manage enjoy the viewpoints and can consider carefully your statements because the i update all of our income tax models and you may instructions. We strive to help make models and you may guidelines which are without difficulty know.

![]()

Short-term absences on your part or even the boy to own unique items, for example school, trips, team, medical care, military solution, otherwise detention inside a great juvenile studio, matter since the go out the little one resided with you. Along with come across Kidnapped son below Which Qualifies as your Centered, prior to, and you can People in the brand new military, after. The next recommendations connect with ministers, people in religious requests who have maybe not taken a promise out of impoverishment, and you will Christian Research therapists. When you are processing Schedule SE as well as the matter on line dos of that plan includes a price which was as well as stated to the Function 1040 or 1040-SR, range 1z, list of positive actions. If you had money out of farming otherwise angling (along with specific number acquired about the the fresh Exxon Valdez litigation), their taxation may be smaller if you opt to contour it using money averaging for the Schedule J. For many who produced a part 962 election and are getting a great deduction below point 250 in terms of people earnings inclusions lower than section 951A, don’t report the newest deduction online twelve.

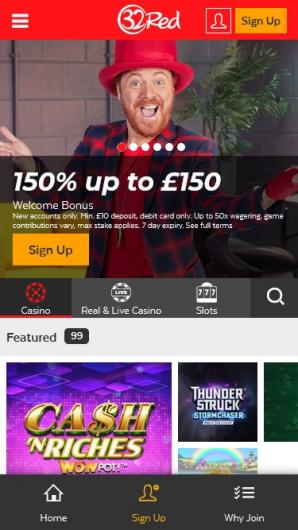

If the range 37 and you will range 38 don’t equal line thirty six, the fresh FTB tend to topic a paper view. Having fun with black colored or bluish ink, make your look at otherwise money buy payable on the “Operation Income tax Panel.” Don’t post dollars and other bits of worth (such seal of approval, lotto passes, foreign exchange, and gift cards). Produce your SSN otherwise ITIN and you may “2024 Function 540 2EZ” to your look at or money buy. Enclose, but never basic the consider otherwise money order to your tax return. To have purposes of Ca income tax, sources so you can a girlfriend, spouse, otherwise girlfriend as well as reference an RDP, until if not given. It is important to enjoy responsibly and if to try out at the very least deposit local casino or people other on line gambling establishment.